Example 120: EUR/JPY H1 8-9th of June 2020: +3% profit (140 pips)

On the higher TFs, we have a bullish wave 3 with a pin bar at the top. So this one is gonna be a contretrend trade! On H1, we have a bullish wave 4 (probably the "c" move), we place a PO below the box as there is no fractal on the left to stop the price to drop. The price breaks nicely the Box and we exit the next day as the prices breaks the upper level of the box for +140 pips which is nearly +3% Profit with our initial risk at 48 pips.

The video of the Trade

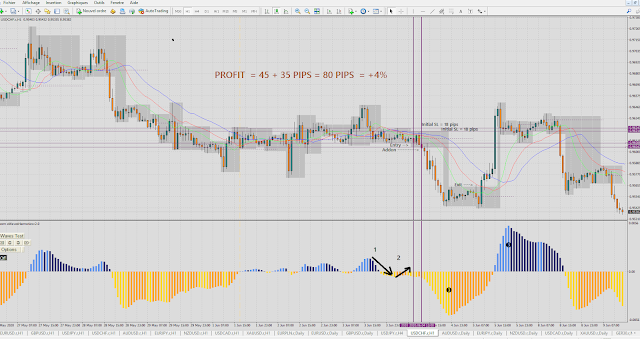

Example 119: USD/CHF H1 4-5th of June 2020: +4% profit (+80 pips)

On D1, the setup is below the box, this is the start of an impulsive wave. On H4, we have a pullback after a wave 3 with a sleeping alligator, this is a double level H1-H4. On H1, we have a nice sleeping alligator inside the box, we put our PO below the double level with a initial SL at 18 pips, the price triggers the PO but retraces, forming a second level, we have a second entry below that new lower level as the alligator starts to open. The price triggers our addon and then after few candles, the price drops. We exit the next morning as the price breaks the upper level of the fractal box for 2 X 2% profit, with a total of +4% profit.

Video of the Trade:

Example 118: GBP/USD H1 26-27th of May 2020: +9% profit (+220 pips)

Nothing great on D1, on H4, the price is reversing, this is the "c" move of the wave 4 who can always become a wave 3 in the opposite direction and the Ewave is about to cross the zero line. On H1, we have a setup 1 during the pacific session, and we have a setup 2 at Francfort Open. For both setups, there is no immediate left levels. We exit during the night as the price breaks the lower level of the fractal box for a total of 9% Profit (for both entries) and +5% Profit for the FO setup. WOW!

Video of the trade:

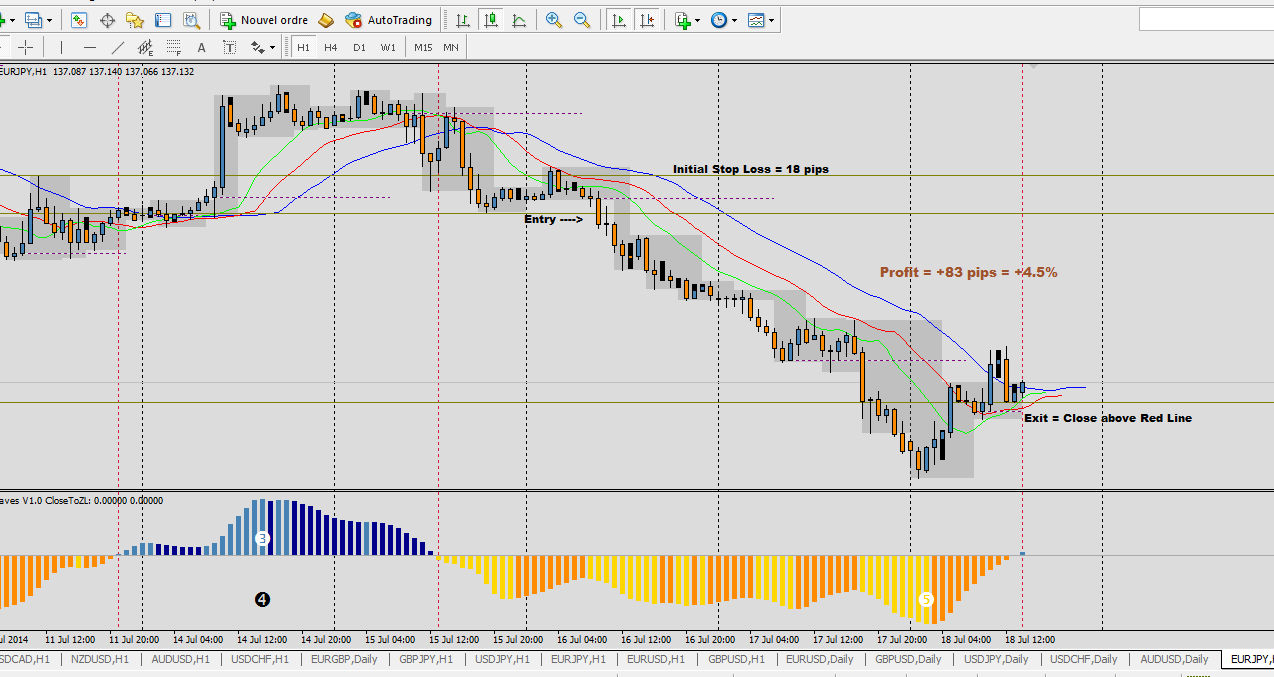

Example 117: EUR/JPY H1 18-19th of May 2020: +4.5% profit (+160 pips)

On D1, we are into the W4, on the H4, we have a sleeping alligator BUT the ewave is about to cross the zero line. We choose to put our pending order above the H4 box (we have a lovely box with a sleeping alligator on H1 below the H1 box. The price triggers on order at NYO and flies, we exit the next day as the price breaks the lower level of the fractal box for a profit of +160 pips (+4.5%). A great one.

Video of the Trade:

Example 116: NZD/USD H1 15th of May 2020: +2% profit (+46 pips)

No trend on D1 but the price has broken the lower level of the fractal box, on H4, bearish wave and on H1, we expect a wave 5. The alligator is sleeping inside the box and the Ewave is about to cross the zero line. Our pending order is just below the box, and our initial SL is above the BRN 1.60 ( at 21 pips). The order is triggered, the price drops and we look for an exit before the end of the week session. TZ1 is not reached so exit at the end of the afternoon for a +2% profit (+46 pips)

Video of the trade:

Example 115: GBP/USD H1 6th of May 2020: +3% profit (+86 pips)

No trend on D1, up and down chart on H4 so for this cable H1 trade, i did not have a lot of confidence. I have used the H4 level (nearly a double level with H1) as en entry and i have chosen to exit before the end of the session using the fib expansion at TZ1 for a nearly +3% profit Trade

Video of the trade

Example 114: USD/JPY H1 28-29th of April 2020: +3.3% profit (+58 pips)

A good trade in the direction of H4 and D1, although the trends were not so solid on those timeframes. Setup at Francfort open, very close to the zero line, the exit, the next day when the price breaks the upper level of the fractal box.

Video of the trade:

Example 113: EUR/USD H1 6-9th of March 2020: +8% profit (+250 pips)

Example 112: USD/CAD H1 26th Jan 2019-2nd Jan 2020: +22% profit (+255 pips)

Mega huge classical trade on H1 in the direction of H4 and D1 with 2 entries for +22% Profit

Video of the trade:

Example 111: USD/JPY H1 on the 31st of October 2019: +3.3 profit (+52 pips)

Lovely trade: Huge BDC on H4 after a 5 wave cycle tells us the new direction, on H1 we take the second break after the pullback.

Video of the trade:

Example 110: GBP/USD H1 on the 8th of October 2019: +2.5 profit (+56 pips)

Classical H1 trade on the direction of the main trend just before the reversal

Video of the trade:

Example 109: GBP/USD H1-H4 on the 14th of June 2019: +5% profit (+70 pips)

It is more an H4 trade with an entry on H1 just before London Open and a TP on H1 as it was the last day of the trading week.

Video of the trade:

Example 108: XAU/USD H1 on the 25th of January 2019 : +4.5% (+142 pips)

Video of the trade:

Example 107: NZD/JPY H1 on the 19-21 of December 2018: +8% (+156 pips)

Video of the trade:

Example 106:AUD/JPY H1 on the 4-6 of December 2018: +8% (+192 pips)

A great example of countretrend trade , please watch the video :)

Video of the trade:

Example 105: USD/JPY H1 on the 23-24 of April: +5.5% (+88 pips)

On the monday 23rd, on D1 this is a bullish corrective wave turning into a new bullish impulsive wave, the price is above the box, on H4 the trend is up with a start of a new bullish wave. On H1, the trend is also up, this setup (break of the box) could be the 3rd break but the price has not move a lot yet and this is the start of the week. We put a pending above the box, the initial Stop Loss below the box is only at 16 pips. The order is triggered at London Open and the price moves quickly up, always away from the green line. The next day at the end of the afternoon, we have a first signal of exit: BDC and divergence, we could exit below the BDC for +110 pips (nearly +7% profit) but we prefer to let the trade run as the Ewave is peaking on H4. Therefore we exit a bit later when the price breaks the lower level of the box for +88 pips (+5.5% profit). A classical trade in the direction of the 3 time frames.

Video of the trade:

Example 104: USD/CHF H1 on the 23-25 of January: +9.5% (+342 pips)

On the 23rd, on D1, we are into an impulsive wave down. On H4, this is a setup: we had a wave 3 down followed by a wave 4 with a sleeping alligator, the ewave is about to cross the zero line. On H1, in the morning we have a tight box, we could have a pending order below the box but there are many levels on the left so we prefer to choose to have a pending order below the H4 level (initial SL above the box at 44 pips) as H4 level is not far away. The order is triggered at 15.00 GMT+1 as the ewave is crossing the zero line. After few hours, the price goes down. We have a second entry below the new box but it is too late (midnight). We take the next entry at London session open below the box (SL above the green line at 28 pips) and the price drops, we exit the next day when the prices crosses the green line for +197 pips (+4.5%) for the first entry and +145 pips (+5%) for the addon so a total of +9.5% profit (+342 pips). This was not the bext exit, we could exit at BRN 0.94 as it was the end of the London session for +15% profit. A great classical trade again.

Video of the trade:

Example 103: GBP/USD H1 on the 12th of January: +134 pips (+5%)

On D1, this is an uptrend (we had a wave 3 followed by a wave 4 and we are currently into an impulsive wave, expecting the wave 5 up). On H4, we had an impulsive wave up followed by a corrective wave, a sleeping alligator and the ewave is about to cross the zero line. On H1, we have a break of the box followed by a pullback, a new buy fractal. This is a double upper level of the box H1-H4. We place a pending order above the box (the SL below the green line is at 25 pips). The order is triggered at London open and the price flies. We exit at the end of the day when the prices reaches the BRN 1.37 for +134 pips, if you choose to exit a bit later just before the end of the session, you get around +160 pips, more than +6% profit. This is a lovely classical trade in the direction of the main trend.

Video of the trade:

Example 102: USD/CHF H1 on the 22-23 of November: +9.5% (+142 pips)

At the moment of the setup, on D1, the alligator's line are reversing and the ewave is about to cross the zero line, on H4, the ewave is also about to cross the zero line, there is a setup too with a sleeping alligator after a small wave down. On wednesday, just Francfort session open, we put a PO below the H4 box which is very close to the H1 box, the initial SL above the H1 box is at 14 pips. We are triggered and the price does not go until Francfort opens, then price drops and pullback forming a new box. We have therefore a second entry below the nex box that we take (initial SL above the green line at 16 pips). The price will not go and retrace before going down and drop. We exit the next morning when the prices crosses the upper level of the fractal box for +78 pips (+5.5%) for the first entry and +64 pips (+4%) for the addon, the total is +142 pips (+9.5% profit) for this quick, small but very profitable trade.

Video of the trade:

Example 101: EUR/USD H1 on the 13-15th of November: +15.5% (+292 pips)

On Monday morning, on D1, the chart is not great with a price inside the alligator, but this is overall an uptrend chart. On H1, the price is above the alligator with the alligator lines starting to open up. On H1, we have a sleeping alligator, and the ewave is crossing the zero line, we put a PO which is trigerred at 3pm (the initial SL, below the box is at 23 pips). The price does not go but never closed below the green line and we are able to move up our SL below the new fractal boxes up to the entry point before Francfort Open on the 14th. At that time, we have a perfect H1 entry: This is a double entry H1-H4, the ewave on H4 is peaking and we have on a 16 pips initial SL. Our PO above the box is triggered and the price flies. Then it moves up harmoniously, our SLs follow the green line and we exit the next day at 17.00 when the price closes below the green line as we have a BDC and a divergence. Profit for the first entry is +152 pips (+6.6%) and for the second entry, we bank +140 pips (nearly +9% ), with a total of +292 pips and +15.5% profit. A great trade, the first entry did not go so you might have exit but the second entry was unmissible.

Video of the trade:

Example 100: GBP/USD H1 on the 5-6th of October: +10% (+250 pips)

On D1, after a BDC, we have a pullback, on H4, after a huge BDC, the trend is down. On H1, we had a lovely wave 3 down on Monday the 2nd, and we expect the wave 5. On the 5th, at Francfort Open, we have a sleeping alligator and a double lower level H1-H4. We put a pending order (SL above the green line is at 25 pips) which is triggered, the prices does not go until London Open with a nice drop, then the price pulls back a bit forming 2 consecutives Inside Bars (NB: Inside bars are usually a setup on the lower time frames). We put a pending order below the first Inside bar (SL at the opposite of the candle at 25 pips) which is triggered, the price then drops harmoniously and we exit the next day before the NFP news for + 150 pips (+6%) for the first entry and +100 pips (+4%) for the addon. A marvelous +10% profit trade, a classical one: we trade the wave 5 (which will become a new wave 3) following the waves 3 and 4.

Example 99: GBP/USD M15 on the 15th of September: +12% (+295 pips)

On the 15th, D1, H4 are into an impulsive wave up. On H1, we have a pullback after a massive push of 250 pips. The ewave looks quite high so we zoom on M15. On M15, we have a clear wave 3 up following by a wave 4 and we want to take the wave 5; We can't take the first break of the box at 6.45 but we can take the break of the box newly formed at 8.30 after Francfort Open (Initial SL at 22 pips below the box), the price breaks the box but then pullback a bit forming a new buy fractal. We take a second entry above this new box (Initial SL at 28 pips below the box). The price breaks the box and flies. We exit both trades at 17.45 while the price breaks the lower level of the box for +154 pips (+7%) and for +140 pips (+5%) for a total of +12% profit, a monster classical trades!

Example 98: NZD/USD H1:22-23rd of May: +6% (+148 pips)

On the 22nd of May, at London Open, on D1 there is no trend but the ewave is about to cross the ZL, on H4, the trend is up, and on H1, we have a double upper level of the box (H4-H1). This is a second entry after a first break. We put a pending order above the double level (initial SL in the other side of the box is at 21 pips) which is immediately triggered, the price goes up and takes a break forming another buy fractal, we place a pending order for this addon which is triggred (initial SL below the green line is at 28 pips), the price goes up nicely, we exit the next, after divergence, while the candle closes below the green line for a profit of 84 pips (+4%) for the 1st entry and + 64 pips (+2%) for the addon, a total of +6% profit (+148 pips): Another excellent classic trade.

Video of the trade:

Example 97: EUR/USD H1: 15-18th of May: +13.5% (+204 pips)

This is a monster classical trade! On the 15th, on D1 this is an uptrend, on H4, we had a wave 3 and we expect a wave 5, the ewave has just crossed the zero line and the price is above the box. On H1, after a push of the price on the 12th, the price is taking a pause and has formed a beautiful box. We place a pending order just before Franfort Open which is triggered quickly (the Stop Loss is only at 15 pips), the price flies and then moves up harmoniously without going below the red line of the alligator. We exit on the 18th, after second divergence, while the candles closes below the green line for +204 pips which means +13.5% profit.

Video of the trade:

Example 96: USD/CHF H1: 9th of May: +6% (+73 pips)

After a strong move on the 8th, the price takes a break, we have 2 buy fractals during the night and the next morning, we have a very small box (12 pips), on H4, the ewave is peaking, we place a pending order at Francfort Open (the price actually broke the box before FO but retraced) above the next fractal on the left which is quickly triggered. The price flies, this is the second push of the wave 3, we exit when the price breaks the lower level of the box for +73 pips, which is +6% profit. A lovely classical setup.

Video of the trade:

Example 95: XAU/USD H1: 11-12th of April: +3.5% (+136 pips)

On the daily chart, this is an uptrend on the 11th, on H4, the ewave is about to cross the zero line, and the H4 upper limit of the box is far away, on H1, we have a valid setup after a break of the box followed by a buy fractal (The box is small with a 40 pip initial SL). The pending order is triggered and the price flies, we exit the next day, in the afternoon for +136 pips (+3.5% profit), a very classical trade. We could let the trade runs as at the break of the lower level of the H1 box, the bars on the H4 ewave were growing up, the exit on the 13th would have brought +6% profit (self half of the profit at the break of the lower level of the box and let the trade runs would have brought nearly 5% profit).

Video of the trade:

Example 94: EUR/USD H1: 29-31st of March: +3.5% (+107 pips)

This is a countertrend trade. On the 29th of March, on D1, we have a bearish chart, and we have a BDC (bearish divergent candle), on H4, we have a lovely BDC, a divergence and the Ewave is about to cross the zero line, 3 signs of a countertrend trade. On H1, we missed the first valid setup (too late in the day) following a lovely BDC and the break of the sleeping alligator box. After some pullback during the night, we take the second entry at London Open which is a double entry H4-H1 (the initial SL is at 30 pips), the price goes down and never closed above the red line neither later the green line, we exit 2 days later while the price breaks the upper level of the box for +107 pips which is +3.5% of profit. The first entry would have given us +6% profit.

Video of the trade:

Example 93: EUR/JPY H1: 9-10th of March: +6% (+160 pips)

On the 9th at London Open, on D1, this is an uptrend chart and the ewave is about to cross the zero line, on H4, this is a wave 3 with the start of a new push. On H1, a sleeping alligator with a small box (initial SL at 25 pips), we place our pending order above the box, the order is triggered and the price flies, then we have a pull back (as the price reaches 2% we can either take half of the position or place our SL at the entry level). The price stays always above the green line and going up harmoniously following that line. We exit before NFP release for +160 pips, more than +6% profit, another classic trade, in the direction of the higher time frames.

Video of the trade:

Example 92: XAU/USD H1: 23-24th of February: +6% (+180 pips)

On the 23rd, on D1, the trend is clearly up, on H4, this a sleeping alligator but the trend is, overall, up. on H1, we had a wave 3 and we expect the wave 5. We have a very small box of 25 pips (SL at 30 pips), we place our pending order which is triggered at London Open. After few hours of hesitations, the price starts to fly, we exit the next day. The smartest exit would have been when the price reached the 1260 BRN for +210 pips (+7% profit) as this is the end of the week, if you have let it run you exit at the close of the week for +180 pips (+6% profit). A very lovely classical trade.

Video of the trade:

Example 91: EUR/JPY H1: 6-7th of February: +3% (+115 pips)

On the 6th of february, on H4, this is the start of a wave down, on H1, we have a small box with a triple lower level (D1, H4 and H1). We place a pending order below the box (the SL above the red line being at 35 pips) which is triggered just before Francfort Open, the price drops and we exit the next morning when the price breaks the upper level of the box for +115 pips which is more than +3% profit. A classical H1 trade in the direction of H4.

Video of the trade:

Example 90: USD/CAD H1: 21 - 23rd of December: +8.5% (+233 pips)

On the 21st of December, on D1, the chart is slightly up and the ewave is about to cross the zero line, on H4, it is a wave up (pulling back), on H1, we have for nearly a day a tight fractal box (Stop Loss is at 31 pips) and the ewave is about to cross the zero line, the upper limit of H4 is at 50 pips so the price has some space to move. We place a pending order above the box which is triggered in the afternoon and the price moves slowly, the next morning, we have a possibility to add on (Stop Loss at 23 pips below a small box). We have an exit signal at the end of the week of trading after a pin bar, we exit below this bar for +141 pips (+4.5%) and +92 pips (+4%) for the addon and a total profit of +8.5% with +233 pips.

Video of the trade:

Example 89: USD/JPY H1: 23 - 25th of November: +6% (+198 pips)

On the 23rd, on D1, this a big wave 3 up, on H4, the wave is up in spite of few divergences, and on H1, we have a small box (initial SL at 35 pips) and the ewave is close to the zero line. We place a pending order above the box which is triggered before NY open. The price flies and we exit on the 25th after few divergences, while the price is breaking the upper level of the box for +198 pips (more than +6% profit). A very good classical trade.

Video of the trade:

Example 88: USD/CHF H1: 1 - 2nd of November: +10% (+150 pips)

On the first of November, on D1, we have an inside bar following a big BDC, on H4 we can see a clear 1-2 move. On H1, we have a wave 3 down following a wave 4 with a very small box. We place a pending order below the box (SL in the other side of the box is only less than 15 pips away) which is triggered at FO, the price drops with 11 bearish candles in the row. We exit the next day while the price breaks the upper level of the box for +150 pips, a massive +10% profit trade.

Video of the trade:

Example 87: USD/JPY H1: 3 - 6th of October: +7% (+181 pips)

On the 3rd, on the daily chart, we have a sleeping alligator, on H4, we have a start of an upper trend in an up and own chart. On H1, we see a setup after an 1-2 move on the ewave. We place a pending order above the box with a SL below the box at 25 pips. The price triggers the order and after some hesitation, the price moves up harmoniously. We exit at the close of the candle below the green line (because of the divergence) for +181 pips (+7% profit). A beautiful classical trade, setup on H1 within the the H4 trend.

Video of the trade:

Example 86: GBP/USD H1: 16th of September: +12% (+352 pips)

On the 16th, at London Open, we expect the wave 5 on D1, on H4, the alligator is sleeping, the potential entry on H1 (below the box) is below the H4 alligator and we have 40 pips to reach the lower level of the box so the price can move therefore this is a valid entry (on the top of that, the ewave is about to cross the zero line). The SL above the box is at 33 pips, the pending order is triggered and the price goes down then bounces forming an inside bar and a new sell fractal, we take a second entry (addon) below the new box with a SL above the inside bar at 25 pips. The price drops with the help of some news releases, we exit at the end of the US sesssion for +193 (+6% for the entry 1) and +159 pips (+6% for the addon), a total of +352 pips (+12%), a huge trade in a single day!

Video of the trade:

Example 85: USD/JPY H1: 6-7 of September: +4.5% (+145 pips)

On the 6th, on H4, we have a divergence of the wave up and the ewave is crossing the zero line, on H1, we have a double level H1/H4, the overall trend on daily is down. We place a PO below the H1/H4 box and the PO is triggered with the news.The price drops quickly and we exit the next when the price breaks the upper level of the box for +145 pips, +4.5% profit trade. An excellent trade based mainly on the daily chart trend and analysis.

Video of the trade:

Example 84: XAU/USD H1: 24-26 of August: +2.5% (+125 pips)

On the 24th, on h4, the trend is slightly down, on H1 we have a wave 3 down and we expect a wave 5, we have a setup: a double level H1-H4 short and the SL is at 50 pips, The po is triggered with the news, and the price drops, we let it run (the wave 5 becomes a new wave 3) , we exit when the price has broken the box after the divergence for +125 pips (+2.5% profit). Good classical trade.

Video of the trade:

Example 83: USD/CHF H1: 6-9th of June: +6% (+156 pips)

After the drop following the NFP release news, the price took a break from sunday to monday forming a lovely sell fractal. We place a pending order (Initial SL above the box for 26 pips) while on H4, the alligator lines are opening in the south direction. The order is triggered and the price, after some hesitation, drops step by step (it remains always below the red line and the box). We exit, classically, three days later, in the morning when the price breaks the upper level of the box for +156 pips, +6% profit. Lovely classical trade (both entry and exit).

Video of the trade:

Example 82: GBP/USD H1: 24-26th of May: +8.5% (+192 pips)

On the 24th, at Francfort Open, we have a very small H1 box of 20 pips, on H4, the overall trend is up, the price is below the alligator but we have a BDC and the box is tall (50 pips to reach the upper level), we place a pending order above the box (SL at 23 pips in the other side of the box) while the ewave is crossing the zero line. The price triggers the order and flies, we have a first exit signal, the next morning (break of the lower level of the box) that we ignore as the bars are peaking on the H4 ewave. We exit the following morning below the green line/break of the box for +192/200 pips which is +8.5% profit trade, a massive trade that i have missed it!

Video of the trade:

Example 81: EUR/USD H1: 13th of May: +5% (+70 pips)

This is an end-of-week- trade, on the 13th of May, on H4, the ewave has started to peak meaning that the alligator is opening. On H1, we have a very small box of 14 pips so we place a pending order which is triggered at Francfort Open. The price drops and we exit before later in the afternoon for +70 pips which is +5% profit.

Video of the Trade:

Example 80: USD/JPY H1: 4-8 April: +9.25% (+400 pips)

This is a beautiful campaign starting by a loss!

On the 4th of April, at 2pm, we have a short setup (SL at 42 pips) as on H4, the alligator is opening and the pending order is below the box but the price will bounce back and we are -1% down. One day later, in the afternoon, we have another lovely short setup. The price did not drop that much and it looks even better on H4 (double lower level with H1) and D1. We place a pending order which is triggered, the price does not move that much but we have to let it run. We have an addon on the 6th while the price has moved +100 pips, the ewave is back to the zero line and the SL is at 38 pips.

The price drops and we exit on the friday morning (SL reached during the night) while the price has crossed the upper level of the box and the previous level.

The total profit is +400 pips (-42, +272, +170) which is +9.25 profit (-1%, +5.75%, +4.5%). A wonderful campaign!

Video of the Trade:

Example 79: GBP/USD H1: 22-23 March: +7% (+255 pips)

The price has dropped and retraced forming a beautiful sell fractal before Francfort Open on the 22nd of March. On H4, the price is reversing so it will be a contretrend trade. The price on H4 is below the red line, below the box and the next level on the left is at 150 pips (we know that this is also a downtrend on D1), we place a PO below the box with a Stop Loss at 36 pips (above the last candle, this is 30min chart upper level of the box). The price drops and never get back above the green line, we exit two days later when the price breaks the upper level of the box for +255 pips, +7% profit.

Video of the Trade:

Example 78: USD/CHF H1: 17-18 March: +4.5% (+90 pips)

After the big move following the release of the FOMC meeting, the price has dropped and then retraced a bit. The next morning at Francfort Open, while the Ewave bars are peaking on H4, we have a very tight box with an initial SL of 20 pips. We put a pending order below the box who is quickly triggered, the price drops for the second push of the move and we exit the next morning while the price breaks the upper level of the box for +90 pips, +4.5% profit. An another beautiful classical trade!

Video of the Trade:

Example 77: GBP/USD H1: 14 March: +3% (+100 pips)

After the big move of the previous day, then the pullback, we look to go long again while the bars of H4 ewave are spiking, on the friday, we place a pending order above the box which is triggered at 11h00. The price, after few hours, flies and we exit before the end of the sesssion for +100 pips (+3% profit).

Video of the Trade:

Example 76: GBP/USD H1: 22-25 February: +6% (+289 pips)

On the 22nd, we have a downtrend on H4 so we are looking for a setup on H1. At Francfort Open, we have a lower level of the H4 fractal box at 48 pips from the H1 upper level of box. We place a PO which is triggered, the prices drops quickly. We have a first signal exit (break of the fracatle box) the next day but this is below the alligator and a quick look at H4 ewave shows that the bars are peaking therefore we choose to ignore this signal preferring to use the red/green lines as SL. This will allow to stay longer into the trade and we exit the 25th at the break of the box (this time above the alligator) for +289 pips, +6% profit. Once again, another very profitable classical trade!

Video of the Trade:

Example 75: EUR/JPY H1: 18-19 February: +9.5% (+282 pips)

On the 18th, we have a downtrend on H4 so we are looking for a setup on H1. At Francfort Open, we have a tight fractal box of 25 pips (formed, on the upper level, by 2 candles with a sama height), we place an order who is immediately triggered. The price goes down slowly forming a new sell fractal. We have an addon few hours later below that fractal with an initial Stop Loss above the green line at 38 pips. The price, then, goes down nicely and we exit the next day just few hours before the close of the trading week for +150 pips (+6%) profit for the first entry and for +132 pips (+3.5%) for the addon, a total of +9.5% profit (+282 pips): Another superbe classical trade.

Video of the Trade:

Example 74: XAU/USD H1: 8-10 February: +3.5% (+180 pips)

On the 8th, on H4, the trend is clearly up so we look for a setup on H1. We find one at 11h , the alligator is sleeping with tight box (50 pips only). We place a pending order and the trade is triggered, the price moves up quickly and we exit the next day when the price breaks the lower level of the fractal box for +180 pips (+3.5% profit). A classical trade.

Video of the Trade:

Example 73: USD/CHF H1: 8-10 December: +8% Profit (+240 pips)

We had a huge wave 3 and we expect now the wave 5. On the 8th of december, at Francfort Open, we have a setup, sleeping alligator and tight box (25 pips), we place a pending order which is triggered, the price is going down slowly forming a new box and we place another pending order (initial stop loss: 35 pisp). The order is triggered and the prices is going down progressively, we exit on the 10th as the prices breaks the upper level of the fractal box for a profit of +130 pips (1st entry) and +110 pips (addon) which makes +240 pips and a profit of +8%. What a terrific classical trade!

Video of the trade:

Example 72: USD/JPY H1: 20-21 August: +5% Profit (+191 pips)

On the 20th at the end of the european sessions, we have a second entry after a first break and a pullback. This break would be a double break with an initial stop loss above the box at 35 pips. On H4, the alligator is opening. We take the double break and the price falls, we exit the next day before the closure of the week for +191 pips, +5% profit. For the traders who let the trade runs over the weekend, this is the jackpot: A +15%-20% profit trade due to the fall of the asiatic markets!

Video of the trade:

Example 71: AUD/USD H1: 26th June: +3% Profit (+63 pips)

On the 26th, we have a H1 setup (2nd break entry after first break), on H4, this is a corrective wave with a nice sleeping alligator and the price below the box. The price has enough space to move before to reach the H4 lower level of the box and the initial stop loss, above the green line, is at 21 pips. The price, after a couple of hours, drops and we exit few hours before the closure of the week for +63 pips, +3% profit.

Video of the trade:

Example 70: AUD/USD H1: 18th June: +2.5% Profit (+75 pips)

On the 18th, on H4, this is a sleeping alligator so in that case, taking a setup on H1 is always a bet. If we do take a setup on H1, the fractal/level on the left must be enough far away for the price to move. This is the case on H1, after the huge long FOMC report candle, we have a pull back and a new fractal has formed. We take the break and the prices, shortly after, flies, we exit few hours later at the break of the lower level of the box for +2.5% (+75 pips)

Video of the trade:

Example 69: EUR/JPY H1: 2-4 June: +6.5% Profit (+325 pips)

Another classical trade: On the 2nd of June, on H4, this is an uptrend with alligator open, we look for a setup on H1. At London Open, we have a small box (50 pips initial stop loss) and we place a pending order above the box, we are triggered and, after a slow start, the price flies. The next morning, we have a first exit signal but as the alligator is opening on H4, we let the trade run. We exit on the 4th, while we have a second exit signal (this time we have also a divergence) when the price breaks the lower level of the fractal box. Our profit is +6.5% (+325 pips). One of the best trades, so far, this year.

Video of the trade:

Example 68: NZD/USD H1: 28-29 May: +3% Profit (+123 pips)

A classical setup. On the 28th, on H4 the trend is down with alligator lines still open. We look for a setup on H1. We have a perfect one with a nice sleeping alligator, the stop loss is 42 pips. We take the break, the price falls after the news and then broke some levels D1 and W1; The H4 ewave is peaking so we let the trade run and dont exit at the first signal (break of upper level of the box), next day, the price drops again and we exit few hours before the end of the week for +123 pips (+3%).

Video of the trade:

Example 67: EUR/USD H1: 19-20 May: +3% Profit (+145 pips)

This is a contre-trend trade. On H4, a cycle of 5 waves has been completed, the price is already below the fractal box. We are looking for an entry on H1, at Francfort open the 19th, we have second break entry while the stop loss above the box is at 45 pips, the price drops at London Open and we exit the next day, after the divergence, when the price breaks the upper level of the box for +3% profit (+145 pips)

Video of the trade:

Example 66: USD/CAD H1: 12-14 May: +2.5% Profit (+86 pips)

We had a wave 3 on H4 and we expect a wave 5. On H1, we have a setup at Francfort Open while it is a sleeping alligator on H4 too. The initial SL is at 30 pips and our PO is 17 pips away from H4 limit so price as enough space to move. We are triggered and the price drops. The next day at Francfort open, we have an exit possible (break of box) but we can also choose to let it run as on H4, the alligator is opening down. Then we have another entry the next hour at London Open, we exit both entries, the next day while the price breaks the upper limit of the box. The total profit of the campaign is +3% and +1% = +4% (142 pips) or +2.5% (86 pips) if you chose to exit as described in the pic below.

Video of the trade:

Example 65: EUR/USD H1: 29-30 April: +6.5% Profit (+205 pips)

Another classical campaign, it is wave 3 up on H4 so we are looking for setups long on H1, the first one is on the 28th at Francfort open (9 am) it is a loss, the 2nd one, also at Francfort open the next day with an initial stop loss at 25 pips; then wa have a third entry few hours later, we are on inversting mode so the stop loss is 50 pips maximum. The price goes up and we exit the next day, the 30th while the price breaks the fractal box down for +205 pips with both entries and nearly +7% profit.

Video of the trade:

Example 64: GBP/USD H1: 24 April: +2.5% Profit (+108 pips)

This is a classical setup: On the 24th, its uptrend on H4, we have a small fractal box on H1 with stop loss at 39 pips as we expect a wave 5; We take the break, price flies and we exit before the end of the week session for more than +2.5% profit (+108 pips)

Video of the trade:

Example 63: EUR/JPY H1: 8-10 April: +5% Profit (+250 pips)

On the 8th, 17.00 (GMT+1), we have a nice setup with a double break H1/H4, this is also a cross of the H4 ewave zero line. The stop loss is, above the H1 box, at 50 pips. The price drops and then we have a pull back but it never goes above the red line, the price, then moves slowly but surely, we exit few hours before the closure of the week for +250 pips (+5% profit).

Video of the trade:

Example 62: USD/CHF H1: 23-25 March +3% Profit (+150 pips)

A trade in the direction of the trend: This is downtrend on H4, on H1 after a move down, there is a pullback and we have a setup at Francfort Open on the 23rd, this is the second break after the break with the sleeping alligator and the stop loss, above the blue line, is at 50 pips. The price drops and then move harmoniously, we exit on th 25th while the prices breaks the upper level of the fractal box above the blue line for +150 pips (+3%).

Video of the trade:

Example 61: USD/CHF H1: 18-19 March +8.5% Profit (+337 pips)

This is a great campaign on USD/CHF, on the 18th (FOMC report day) at Francfort open, I have a tight fractal box and the ewave is about to cross the zero line, this is a H1 setup. I check on H4, the ewave is also on the way to cross the zero line (and H1 pending order is below the H4 red line, price has some space to move to reach the H4 limit as well), therefore this is a double H1/H4 cross of the zero line! I take the H1 break, the price drops slowly forming a new sell fractal, I take a second entry below that fractal (this is also a double break H1/H4) with a stop loss above the red line at 45 pips as we are in an investing mode, the price drops. Before the FOMC report (like NOFP news), my strategy is to sell half of my position to reduce the risk, then the news came and go in my way, cool. I exit above that huge BDC for a total profit of +8.5% (+5.5% and +3%) and +337 pips (+187 and +150).

N.B. I could have taken my profit (or half of them) when the prices has reached the D1 red line.D1 alligator lines are excellent SL and TP.

Video of the trade:

Example 60: EUR/JPY H1: 10-12 March +6% Profit (+306 pips)

This another classical trade. It is a clear downtrend on D1 & H4, we have a nice setup on H1 with a relatively tight fractal box and an Ewave cross of zero line, we take the break and the price drops nicely and we exit 2 days later while the price crosses the fractal box in the opposite side for +306 pips = +6% profit!

Video of the trade:

Example 59: GBP/USD H1: 6th March +5.5% Profit (+110 pips)

On D1, H4 & H1, this is downtrend, on H1 we have a very tight fractal box and the ewave is about to cross the zero line. We take the break, and the price falls. This is the NFP release news so we sell half of our position (+2% / 2 = +1%) before the news and let our trade runs. Following the news, the price goes in our way (as often, price goes in the main trend direction) and we exit few hours before the end of the week for +9% / 2 = +4.5%; the total profit is +5.5%. Great quick trade.

Video of the trade:

Example 58: EUR/USD H1: 26-27 February: +2.5% Profit (+120 pips)

We knew D1 was downtrend, on H4 we have a nice sleeping alligator, on H1 same, we have a sleeping alligator & the Ewave is about to cross the zero line (always a strong signal), we take the H4 break and the price drops before the news. The news are poor for the USD but the price keeps falling and we exit the next morning when price breaks the opposite side of the fractal box for +120 pips (+2.5%)

Video of the trade:

Example 57: USD/JPY H1: 10-12 February: +4.5% Profit (+140 pips)

The classical ones, the best ones: On Tuesday 10th at Francfort Open, we have a clear direction on H4, the alligator is wide open to the north, it is uptrend. On H1, we have a sleeping alligator inside a tight fractal box. We take the break, the price moves harmoniously and we exit the 12th at the break of the lower level of the box for +140 pips (+4.5% Profit)

Video of the Trade:

Example 56: USD/CHF H1: 26-27 January: +2.5% Profit (+170 pips)

On the 26th, the trend is up on H1, we have the ewave close to the zero line, there is a small divergence but this is London open and on H4, the ewave is starting to peak with a price outside the box, we take the H1 break, the price flies and we exit when it breaks the box in the opposite side for +2.5% Profit (=170 pips)

Video of the trade:

Example 55: XAU/USD H1: 20-21 January: +2.75% Profit (+164 pips)

On the 20th of January, the H4 alligator is open, it is an uptrend. We look for a setup on H1, there we have a sleeping alligator and a tight box . We place the pending order above the box. The price breaks the box and moves up and we exit when it break the box in the opposite side for +164 pips (+2.75%)

Video of the trade:

Example 54: USD/JPY H1: 13 January: +2.5% Profit (+112 pips)

On the 13th of January, the H4 alligator is open, we have also an inside bar. We look for a setup on H1, there we have a sleeping alligator and a tight box . We place the pending order below the box. The price drops and we exit when it break the box in the opposite side for +112 pips (+2.5%)

Video of the trade (+ USD/CAD: +2.5%):

Example 53: GBP/USD H1: 2 -7 January: +19.5% Profit (+390 pips)

A monster campaign on Cable: It starts on the first day of the year of trading at Francfort Open: On H4, the ewave is about to cross the zero line and the alligator is sleeping, the price broke the level but did not go. On H1, we have 6 candles with the same low and a very tight box! We put a pending order below those 6 candles and the price drops, the price makes 200 pips and we let it run (you could exit before the end of the session for +10% profit), we exit for +290 pips the 5th of January, that was our first entry. 2nd entry the 6th of January also at FO, the price has retraced and we have a very tight box, we take the break and the price drops again, we exit the 7th while the price broke the opposide side of the fractal box. We have +14.5% profit for the first entry (+290 pips) and +5% profit for the seconde entry (+100 pips)! What an amazing way to start the year!

Video of the trade:

Example 52: XAU/USD H1: 9-10 December: +200 pips (+3.5%)

On H4, we have a perfect setup with a sleeping alligator and an Ewave about to cross the zero line, we look for an entry on H1. On H4, we missed the first break of the fractal box during the night and the second break before Francfort Open. We take the third break as the price did not go far and our initial stop loss is below the green line because we are in an investing mode (Risk: 60 pips). The prices flies and we exit at the candle who closes below the green line after the divergence for 200 pips (+3.5% Profit).

Video of the trade:

Example 51: EUR/USD H1: 2-4 December: +10% (+140 pips)

This is downtrend on the daily chart, on H4, we have a sleeping alligator and the fractal box is big so the price has space to move. The 2nd of Decembre at Francfort Open, we have a H1 setup with a sleeping alligator and a very tight box, we take the break and the price moves down harmoniously, we exit 2 days later when the price breaks the upper level of the fractal box for +140 pips, an amazing +10% profit trade.

Video of the Trade:

Example 50: EUR/USD H1: 21 November: +135 pips (+3.5%)

This one is a contre-trend trade. On H4, its downtrend and we expect the wave 5, on the 19th we do have a BDC indicating a possible change of H4 direction, so we look at a setup on H1; We have a perfect one on the Friday London Open with a lovely inferior level of the fractal box. We take the break and the price dropes, we have a perfect exit at the bottom of the D1 box for +135 pips.

Video of the trade:

Exemple 49: EUR/JPY H1: 13-14 November: +134 pips (+4%)

On H4, the alligator is opening and the ewave is starting to peak. We take the second break out of the fractal box on H1 (on the first break, the risk is too high with a SL at more than 60 pips), the initial stop loss is below the green line as we are in an investing mode (32 pips), the price goes up slowly but surely and we exit on Friday afternoon, we have a perfect exit when the prices reaches the monthly highest for +134 pips.

Video of the trade:

Example 48: GBP/USD H1: 13-14 November: +126 pips (+6%)

This one is a tricky one. The price has dropped after the news on GBP, the next day, on the 13th, there is another break after a retrace, this is the 3rd break and price has already moved for +175 pips so we could have filtered the setup, however, the ewave has just started to pic on H4 and the risk is only 30 pips. We take the break and it drops again, on Friday we have a perfect exit at BRN 1.56 for +6% profit.

Video of the trade:

Example 47: USD/CAD H1: 3-5 November: +120 pips (+4%)

On H4, its an uptrend with alligator open, we had a first break of the fractal box on H1 and after a retrace we take this second break. The price flies and is always above the red line, we exit when the candle crosses the green line after the 3rd divergence (not before as the H4 ewave was still close to the zero line and was peaking)

Video of the trade:

Example 46: XAU/USD H1: 29-31 October: +550 pips (+11%)

Its downtrend on Daily Chart and alligator is open on the H4 Chart, we have a lovely double lower level of the fractal box (H4-H1), we take the break and the news (FOMC report) goes in our way, we exit only friday afternoon, few hours before the market close. A wonderful classic trade!

Video of the trade:

Example 45: GBP/USD H1: 14 October: +135 pips (+5%)

Its downtrend on H4 and we expect the wave 5, we take the break on H1 but below the H4 fractal box. The price drops and is booted by the news. We exit when the price breaks the opposite level of the fractal box.

Video of the trade:

Example 44: GBP/USD H1: 3 October: +159 pips (+7%)

An H1 trade in the direction of H4: The breakout went before the NFP release news at Francfort Open and the news went in our way. If you have sold one half of your position before the news to protect your profit, you would get +4%.

Video of the Trade:

Example 43: EUR/USD H1: 24-26 September: +140 pips (+5%)

An H1 trade in the direction of H4: We expect the wave 5, we take the setup on the double break H1-H4 of the fractal Box

Video of the trade:

Example 42: EUR/JPY H1: 17-19 September: +250 pips (+9.5%)

Classical trade in the direction of H4 with a double break H1-H4

Video of the trade:

Example 41: USD/CAD H1: 8-12 September: +7% (+132 pips)

A classical completed 5 wave trade action

Video of the trade:

Example 40: GBP/USD H1: 2-3 September: +4% (+100 pips)

Video of the Trade:

Example 39: USD/CAD H1: 26-28 August: +6% (+96 pips)

Video of the Trade:

Example 38: EUR/USD H1: 18-21 August: +11.5% (+208 pips)

Video of the Trade:

Example 37: USD/JPY H1: 29-30 July: +13% (+154 pips)

The Trade:

This is a classical one: On the 29th at the break (15h), the H4 alligator is open and the AO is peaking, we take another entry at LO on the 30th (H4 AO peaking and double break) after the small retrace. We prefer to exit both positions before the FOMC report.

Example 36: EUR/USD H1: 22 July: +5% (+50 pips)

The Trade:

Its a classical one, at Francfort Open, we have a very tight fractals Box and H4 shows clearly a downtrend; See also the nice 1-2 move before the drop.

Example 35: EUR/JPY H1: 16-18 July: +4.5% (+83 pips)

Video of the Trade:

Example 34: EUR/JPY H1: 10 July: +6%

Video of the Trade:

Example 33: XAU/USD H1: 19 June: +670 pips (+15%)

Video of the Trade:

Example 32: XAU/USD H1: 12-13 June: +120 pips (+4%)

Video of the Trade:

Example 31: GBP/USD H1: 28 May: +75 pips (+7.5%)

Video of the trade:

Example 30: AUD/USD H1: 19-21 May: +100 pips (+4%)

Video of the trade:

Example 29: GBP/USD M15: 6-7 May: +82 pips (+8%)

Video of the trade:

Example 28: USD/CAD H1: 29 April: +60 pips (+5%)

Video of the trade:

Example 27: GBP/USD H1: 16 April: +87 pips (+5%)

Video of the trade:

Example 26: USD/CHF H1: 7-11 April: +374 pips (+25%)

Video of the trade:

Example 25: GBP/USD H1: 8-9 April: +110 pips

Video of the Trade

Example 24: EUR/JPY H1: 1-2 April: +85 pips

The trade:

This one is a classical one: H4 is clearly an uptrend with an open alligator. On H1, although, the up move has started already, we have a setup on the 1st of April at Francfort Open as there is no divergence & the AO is close to the ZL. Our Stop Loss, located below the red line, is at 28 pips; We take the break of the fractal box and the price moves up. We exit when the prices crosses the lower level of the fractal box for +85 pips = +3% Profit.

Example 23: EUR/JPY M5: 28 March: +176 pips

The trade:

On H1, we see after a wave 3 and a divergence, the start of a strong corrective wave, we note a break of he upper fractal box level as the AO is about to cross the zero line; We can't enter on H1 but we zoom on M15 and then M5 to check that we have a double setup ( M5 & M15 sharing the same level); We enter into the trade as the risk (Stop loss) is 18 pips, located below the lower fractal box level, we addon after the break of a new upper level (with a risk of 10 pips) formed after a small retracement. We exit after the divergence of the wave 3 when price breaks the fractal box level for a +96 pips (1st entry) and + 80 pips (addon ). Our profit is +5% + 8% = +13 % Profit! Amazing!

Example 22: XAU/USD H1: 17-20 March: +650 pips

The trade:

On H4 we have a BDC showing a possible new direction. Moving to H1 , we see that a 5 wave sequence has been completed therefore we are looking for any setup in any direction. We have a first break of the lower level of the Fractal Box then a retrace forming a new lower level. We place a PO under that new level while the AO has crossed the zero line (the Stop Loss located above the Box is at 85 pips). We are triggered and the prices drops nicely, few addons are possible (during the night) but we addon the 19th while the AO has come back to the zero line (The Stop Loss located above the red line is at 65 pips). We exit on the candle who closes above the green line (after the divergence) for +435 pips = +5% profit for the first entry and +215 = +3% for the 2nd entry. Total: an amazing +650 pips (+8% Profit)

Example 21: USD/CHF H1: +12-13 March: +46 pips

The trade

On D1 and H4, its cleary a downtrend. We look for an entry on H1 as the AO is close to the zero line. We place a pending order just below the fractal box and our Stop Loss is located just above that box at 16 pips. The order is triggered and the price drops, we exit at the candle who closes above the red line of the Alligator for a +46 pips = +2.5% Profit. Note that with the same entry on M5, the risk was only 8 pips for a +6% Profit trade!

Example 20: EUR/USD H1: 6-7 March: +180 pips

The trade:

On D1, it is an uptrend, on H4, the AO is crossing the zero line (a strong signal) so its a perfect H4/D1 trade but we look at H1 to find a setup. We set up a pending order during the London session of the 6th March but not above the H1 upper level of the Fractal Box but above the H4 level as there is no trend yet on that time frame (Initial Stop Loss below the lower level of the Fractal Box at 30 pips). We are tiggered and the price flies after the USD news release. We have an addon the next day at Francfort Open as the price breaks a new Box level (Initial Stop Loss below the lower level at 15 pips). We exit both positions before the NFP release for +150 pips (+5%) and + 30 pips (+2%) for a total Profit of +180 pips = +7%!

Example 19: NZD/USD H1: 5-7 March: +90 pips

The trade:

Its uptrend on the higher TFs so we are looking at setups on H1 as the session is opening in London on the 5th. We have a new break of the Fractal Box as the stop loss is located below the lower level of the Box (at 21 pips). The price goes up and we could exit at the BRN for +90 pips but we let the trade run as we are in a wave 3; We exit on the 7th just before the NFP release for +90 pips, more than +4% Profit.

Example 18: USD/CHF H1: 28 february: +76 pips

The trade:

It is downtrend on H4; At Francfort Open, we do have a setup on H1 however, as the H4 alligator is not totally open, we prefer to place our pending order below the lower level of the H4 fractal box at 20 pips of our stop loss located above the upper level of the H1 fractal box. We are triggered and the price drops. We have to exit before the close of the last session of the week and of the month for +80 pips = about +4% Profit.

Example 17: EUR/JPY M5: 27 february: +98 pips

The trade:

On H1, the trend is down, we could enter on H1, at the break of the fractal Box, just below the BRN 140.00 however, as the whole month has been a bit choppy, we zoom into the lower TFs to check how look the charts. On M5, we have the same entry with a 16 pip risk (Initial Stop Loss just above the upper level of the fractal Box), we enter and the price drops quickly. We follow the lines of the Alligator for the exit and when the candles closes above the green line after a divergence between the price and the AO, we exit for +98 pips, nearly +6% Profit! Note that an addon was possible at the 2nd break (after the retrace) with a 10 pip risk and a +60 pips profit (+6%), therefore a +14% profit was possible on that EUR/JPY campaign!

Example 16: EUR/USD H1: 13-14 february: +47 pips

The trade:

After the NFP release, the trend is up on H4. On the 13th we look for an entry on H1 as a new upper level of the Fractal Box has been formed at Francfort Open. We take the break of the Fractal Box and the price flies. Our initial Stop Loss is below the precedant Open Line with 18 pips. We exit, after seeing a divergence between the price and the AO, at the close of the candle below the green line for +47 pips = +2.5%

Example 15: GBP/USD H1: 30-31 january: +72 pips

The trade:

On H4, a huge BDC (bearish divergent candle) shows a new direction and the price has formed 2 consecutive inside bars before Francfort Open so we look for a setup on H1. There, we can see that the price has formed a tight fractal Box and we place a pending order just below the candle who already broke that lower level of the Box (our initial stop loss is located just above the Box for 20 pip risk). The order is triggered and the price falls, we exit at the candle who closes above the green line (there is a divergence between the price and the AO) for +72 pips and a profit of +3.5%.

Example 14: EU/USD H1: 30-31 january: +80 pips

The trade:

A classic break of the fractal Box while the Alligator was sleeping. On H4, we see that the price has not moved and had formed 3 consecutive inside bars. The H4 AO is crossing the zero line (a strong signal) so i look for a setup on H1. On H1, the Alligator has sleepy for a while and we look for a break of the fractal Box. It happens at Francfort Open, we have placed a pending order below the previous lower level of the Box (on the left as the price has broken already the current lower level). The PO is triggered and the price falls. We exit at the break of the upper level of the Box the next morning for +80 pips. As my initial stop loss was above the Alligator (+26 pips), my profit is +3%. If i choose to let some space to the price, i would be still in the trade friday afternoon as the price never close above the red line. I would exit for about +150 pips (before the end of the week), +6% profit.

Example 13: EU/USD H1: 23-24 january: +120 pips

The trade:

A classic breakout trade at the cross of the AO zero line. On H4, we can clearly see a 5 wave completed sequence. We expect a new move and look for an setup on H1. On H1, we see a small box and a sleeping alligator, we take the break of the upper level of the fractal Box while the AO is crossing the zero line (a strong signal). Our Stop Loss, below the lower level of the fractal Box is 28 pips. The price breaks the box and flies, we look for the first signal of exit as the price has moved fast and we dont want to give our profit back. We exit at the break of the lowel level of the Box for a nice +120 pips. The profit is about +4.5 %.

Example 12: USD/JPY H1: 23-24 january: +220 pips

The trade:

A classical double break of the fractal Box. On H4, the price has been ranging, we look for a break of the fractal Box. H4 and H1 share the same lower level of the fractal Box ( a very strong entry if the price breaks). We place a pending order below the box and got triggered (the Stop Loss is above the green line for 20 pips). The price falls nicely and then retraces during the night, we let our trade run. The next day (friday) it drops again, we look for an exit that day as it is the last day of the trading week. The BRN at 102.00 looks a perfect TP and it is hit for +220 pips profit. We have an outstanding 220/20=+10% profit!

Example 11: EU/USD H1: 17 january: +128 pips

The trade:

A classical trade in the direction of the main trend. On H4, we had a wave 3 and we are expecting a wave 5. The H4 alligator is starting to open as we see a setup on h1 at Francfort Open (break of the fractal box & cross of the AO zero line). We enter at the break of the box with a small risk of 13 pips (size of the box); The price drops then retraces a bit forming another lower level of the box. We enter here again as an addon (SL above green line = 26 pips). We exit both trades before the week session closes. Our profit = +72 pips = +5.5% and +56 pips = +2% for a total of +7.5%!

.

Example 10: AU/USD H1: 14-16 january: +220 pips

The trade:

A perfect contretrend Trade: We have a good setup on H1 on the 14/01, the alligator is asleep, the AO has just crossed the zero line and the price has slightly retraced forming a new fractal Box. We look at higher time frames: D1 is down trend, H4 is an uptrend but we can clearly see that the price has formed a BDC (bearish divergent candle), strong signal for a short. Therefore we take the break of the Box on H1, our Stop Loss is in the other side of the Box (about 30 pips). The price drops, we will exit above the green line (close of the candle) of the alligator if the AO and the price have diverged, on the red line if they have not diverged or in the other side of the Box, if the price has moved to quickly. We let the trade run and we exit above the green line after a small divergence on the 16/01 for +220 pips = >+7%. We could also let it run for more and exit above the fractal Box. An addon was possible at 2.AM (Paris time) for 140 pips more!

Example 9: EUR/JPY H1: 2-4 january: +230 pips

The trade:

An example of a contretrend on simple break of the H1 fractal Box. We enter at the break as showed on the chart. The price drops. We exit a the close of the candle who finishes above the green line of the alligator after that the price and the AO have diverged. The initial stop loss was above the upper level of the fractal box = 45 pips, therefore the profit is 230/45 =more than 5%!

Example 8: Gold H1: 9-11 December: +234 pips

Again, another good gold H1 trade

The trade:

We have a sleepy alligator on H4 but that strong Bullish Divergent Candle on the 6th shows a potential new direction. On H1, we have a sleeping alligator and we are looking for an entry signal. We enter at the break of the fractal box, the price flies, we exit at the lower break of the fractal box on the 11th after the prices crossed the red line for +234 pips (we could have exit on the first lower break of the fractal box at 2 am for +262 pips). The risk was 58 pips (size of the box) so our profit is +4%.

Example 7: GBP/USD HA: 9-10 December: +71 pips

Nice little Cable H1 trade

The trade:

D1 is uptrend, the alligator is sleeping on H4 and H1, we have an entry signal (blue dot) on H1. We enter at the break of the Box at Francfort Open the 9th december, the price goes up, we exit the next day, we have an exit signal (red dot) and we exit at the close of the red candle below the red line of the alligator for +71 pips. The risk was 35 pips (size of the box), therefore our profit is +2%

Example 6: H1 Gold 2-3 December for 216 pips

Classical break of fractal on gold

The trade:

The higher time frames are showing a short trend (H4 looks like at the end of wave 4 based on Fibonacci retracement), we expect a wave 5 on H4 and we are looking for an entry on H1. We enter at the break of the fractal box, the price drops. We exit at the close of the candle above the green line (based on the Fibonacci expansion, the price has reached TZ1) for +216 pips. Our initial risk was 36 pips (distance betwween the red line and the entry point) so our profit is +6%.

Example 5: H1 Gold 20th of November for 240 pips

A fractal break for a very good run on gold

The trade:

H4 and the higher time frames are short. We have a fractal box break as we were expecting a wave 5 on H1; The prices drops as the wave 5 becomes a new wave 3 and we have a very nice trade ending at the break of the fractal box upper level for 240 pips. Our initial risk was 40 pips (size of the fractal box + spread + 2 pips) therefore our profit is +6%. Thanks gold!

Example 4: H1 GBP/USD 11th of November: 92 pips

A classical entry for a 92 pips profit

The trade:

The AO has started to peak and the alligator mouth is open on H4. We have a break of the lower Fractal box on H1 with a risk of 32 pips (size of the box + spread + 2 pip marge) so we enter here. The prices drop then retrace a bit, The next day, we exit just above the green line and before the GB red news release for 92 pips so nearly 3% growth. An addon was possible just before Francfort Open the 12th (risk 30 pips) for a 60 pips profit (2% gowth) meaning a total of 152 pips (5% growth)

Example 3: M1 EU/JPY 7th of November: 42 pips

Nice 42 pips following the surprise on Euro minimum bid rate

The trade:

The trend is short after that huge move following the red news. After such a strong move, there are always good opportunities on the lower time frames (wave 5 to hit). All the higher time frames are short, we look an entry on the smaller time frames to hit the wave 5. We like when the AO is changing color at the cross of the zero line. We have an entry on M1 right after the red dot alarm. We enter here at the break of the fractal box and the price falls. We exit at the break of the fractal box upper level for 42 pips; As our initial risk (size of the box) was 12 pips, our profit is 3.5%

Example 2: M15 GBP/USD 1st November 2013

A very good new trade to start November on M15 GBP/USD using Science of Chaos!

The trade:

The trend is short on H1. We look for an entry on M15. The Alligator is asleep. Our entry is at the first break of the fractal Box (The Stop Loss is at the other side of the Box = 20 pips = 1%). The pice drops then take a pause before dropping again and breaks a new level of the fractale Box (Addon= Second entry with a Stop Loss above the green line at 20 pips = 1%).

After the display of the blue dot, our exit signal, we close the trade at the break of the upper level of the fractal Box for 94 + 60 = 154 pips = 7.7%of profit!

Simple and stress free!

Example 1: EUR/USD M5 31OCTOBER 2013

The trade:

The trend is down (the purple line is above the price). The Alligator is asleep, and after a nap, he will wake up hungry! The red dort warns me of a potential short trade. My Stop Loss is 17 pips. Our entry is when the price breaks the Fractal Box and it drops; we stay in the trade and we exit when price preaks the upper level of the fractal Box: Profit: +54 pips, 3 times bigger than my risk (if risk is 1%, profit is +3%)

On the higher TFs, we have a bullish wave 3 with a pin bar at the top. So this one is gonna be a contretrend trade! On H1, we have a bullish wave 4 (probably the "c" move), we place a PO below the box as there is no fractal on the left to stop the price to drop. The price breaks nicely the Box and we exit the next day as the prices breaks the upper level of the box for +140 pips which is nearly +3% Profit with our initial risk at 48 pips.

The video of the Trade

Example 119: USD/CHF H1 4-5th of June 2020: +4% profit (+80 pips)

On D1, the setup is below the box, this is the start of an impulsive wave. On H4, we have a pullback after a wave 3 with a sleeping alligator, this is a double level H1-H4. On H1, we have a nice sleeping alligator inside the box, we put our PO below the double level with a initial SL at 18 pips, the price triggers the PO but retraces, forming a second level, we have a second entry below that new lower level as the alligator starts to open. The price triggers our addon and then after few candles, the price drops. We exit the next morning as the price breaks the upper level of the fractal box for 2 X 2% profit, with a total of +4% profit.

Video of the Trade:

Example 118: GBP/USD H1 26-27th of May 2020: +9% profit (+220 pips)

Nothing great on D1, on H4, the price is reversing, this is the "c" move of the wave 4 who can always become a wave 3 in the opposite direction and the Ewave is about to cross the zero line. On H1, we have a setup 1 during the pacific session, and we have a setup 2 at Francfort Open. For both setups, there is no immediate left levels. We exit during the night as the price breaks the lower level of the fractal box for a total of 9% Profit (for both entries) and +5% Profit for the FO setup. WOW!

Video of the trade:

Example 117: EUR/JPY H1 18-19th of May 2020: +4.5% profit (+160 pips)

On D1, we are into the W4, on the H4, we have a sleeping alligator BUT the ewave is about to cross the zero line. We choose to put our pending order above the H4 box (we have a lovely box with a sleeping alligator on H1 below the H1 box. The price triggers on order at NYO and flies, we exit the next day as the price breaks the lower level of the fractal box for a profit of +160 pips (+4.5%). A great one.

Video of the Trade:

Example 116: NZD/USD H1 15th of May 2020: +2% profit (+46 pips)

Video of the trade:

Example 115: GBP/USD H1 6th of May 2020: +3% profit (+86 pips)

No trend on D1, up and down chart on H4 so for this cable H1 trade, i did not have a lot of confidence. I have used the H4 level (nearly a double level with H1) as en entry and i have chosen to exit before the end of the session using the fib expansion at TZ1 for a nearly +3% profit Trade

Video of the trade

Example 114: USD/JPY H1 28-29th of April 2020: +3.3% profit (+58 pips)

A good trade in the direction of H4 and D1, although the trends were not so solid on those timeframes. Setup at Francfort open, very close to the zero line, the exit, the next day when the price breaks the upper level of the fractal box.

Video of the trade:

Example 113: EUR/USD H1 6-9th of March 2020: +8% profit (+250 pips)

Lovely +8% profit classical trade: The wave 5 in H1 becoming a new wave 3. Tricky exit as this was NFP release day so i have banked half of my profit at BRN 1.13 and let the other half run over the weekend for an exit on monday at the close of the candle below the red line.

Video of the trade:

Example 112: USD/CAD H1 26th Jan 2019-2nd Jan 2020: +22% profit (+255 pips)

Mega huge classical trade on H1 in the direction of H4 and D1 with 2 entries for +22% Profit

Video of the trade:

Example 111: USD/JPY H1 on the 31st of October 2019: +3.3 profit (+52 pips)

Lovely trade: Huge BDC on H4 after a 5 wave cycle tells us the new direction, on H1 we take the second break after the pullback.

Video of the trade:

Example 110: GBP/USD H1 on the 8th of October 2019: +2.5 profit (+56 pips)

Classical H1 trade on the direction of the main trend just before the reversal

Video of the trade:

Example 109: GBP/USD H1-H4 on the 14th of June 2019: +5% profit (+70 pips)

It is more an H4 trade with an entry on H1 just before London Open and a TP on H1 as it was the last day of the trading week.

Video of the trade:

Example 108: XAU/USD H1 on the 25th of January 2019 : +4.5% (+142 pips)

Video of the trade:

Example 107: NZD/JPY H1 on the 19-21 of December 2018: +8% (+156 pips)

Video of the trade:

Example 106:AUD/JPY H1 on the 4-6 of December 2018: +8% (+192 pips)

A great example of countretrend trade , please watch the video :)

Video of the trade:

Example 105: USD/JPY H1 on the 23-24 of April: +5.5% (+88 pips)

On the monday 23rd, on D1 this is a bullish corrective wave turning into a new bullish impulsive wave, the price is above the box, on H4 the trend is up with a start of a new bullish wave. On H1, the trend is also up, this setup (break of the box) could be the 3rd break but the price has not move a lot yet and this is the start of the week. We put a pending above the box, the initial Stop Loss below the box is only at 16 pips. The order is triggered at London Open and the price moves quickly up, always away from the green line. The next day at the end of the afternoon, we have a first signal of exit: BDC and divergence, we could exit below the BDC for +110 pips (nearly +7% profit) but we prefer to let the trade run as the Ewave is peaking on H4. Therefore we exit a bit later when the price breaks the lower level of the box for +88 pips (+5.5% profit). A classical trade in the direction of the 3 time frames.

Video of the trade:

Example 104: USD/CHF H1 on the 23-25 of January: +9.5% (+342 pips)

On the 23rd, on D1, we are into an impulsive wave down. On H4, this is a setup: we had a wave 3 down followed by a wave 4 with a sleeping alligator, the ewave is about to cross the zero line. On H1, in the morning we have a tight box, we could have a pending order below the box but there are many levels on the left so we prefer to choose to have a pending order below the H4 level (initial SL above the box at 44 pips) as H4 level is not far away. The order is triggered at 15.00 GMT+1 as the ewave is crossing the zero line. After few hours, the price goes down. We have a second entry below the new box but it is too late (midnight). We take the next entry at London session open below the box (SL above the green line at 28 pips) and the price drops, we exit the next day when the prices crosses the green line for +197 pips (+4.5%) for the first entry and +145 pips (+5%) for the addon so a total of +9.5% profit (+342 pips). This was not the bext exit, we could exit at BRN 0.94 as it was the end of the London session for +15% profit. A great classical trade again.

Video of the trade:

Example 103: GBP/USD H1 on the 12th of January: +134 pips (+5%)

On D1, this is an uptrend (we had a wave 3 followed by a wave 4 and we are currently into an impulsive wave, expecting the wave 5 up). On H4, we had an impulsive wave up followed by a corrective wave, a sleeping alligator and the ewave is about to cross the zero line. On H1, we have a break of the box followed by a pullback, a new buy fractal. This is a double upper level of the box H1-H4. We place a pending order above the box (the SL below the green line is at 25 pips). The order is triggered at London open and the price flies. We exit at the end of the day when the prices reaches the BRN 1.37 for +134 pips, if you choose to exit a bit later just before the end of the session, you get around +160 pips, more than +6% profit. This is a lovely classical trade in the direction of the main trend.

Video of the trade:

Example 102: USD/CHF H1 on the 22-23 of November: +9.5% (+142 pips)

At the moment of the setup, on D1, the alligator's line are reversing and the ewave is about to cross the zero line, on H4, the ewave is also about to cross the zero line, there is a setup too with a sleeping alligator after a small wave down. On wednesday, just Francfort session open, we put a PO below the H4 box which is very close to the H1 box, the initial SL above the H1 box is at 14 pips. We are triggered and the price does not go until Francfort opens, then price drops and pullback forming a new box. We have therefore a second entry below the nex box that we take (initial SL above the green line at 16 pips). The price will not go and retrace before going down and drop. We exit the next morning when the prices crosses the upper level of the fractal box for +78 pips (+5.5%) for the first entry and +64 pips (+4%) for the addon, the total is +142 pips (+9.5% profit) for this quick, small but very profitable trade.

Video of the trade:

Example 101: EUR/USD H1 on the 13-15th of November: +15.5% (+292 pips)

On Monday morning, on D1, the chart is not great with a price inside the alligator, but this is overall an uptrend chart. On H1, the price is above the alligator with the alligator lines starting to open up. On H1, we have a sleeping alligator, and the ewave is crossing the zero line, we put a PO which is trigerred at 3pm (the initial SL, below the box is at 23 pips). The price does not go but never closed below the green line and we are able to move up our SL below the new fractal boxes up to the entry point before Francfort Open on the 14th. At that time, we have a perfect H1 entry: This is a double entry H1-H4, the ewave on H4 is peaking and we have on a 16 pips initial SL. Our PO above the box is triggered and the price flies. Then it moves up harmoniously, our SLs follow the green line and we exit the next day at 17.00 when the price closes below the green line as we have a BDC and a divergence. Profit for the first entry is +152 pips (+6.6%) and for the second entry, we bank +140 pips (nearly +9% ), with a total of +292 pips and +15.5% profit. A great trade, the first entry did not go so you might have exit but the second entry was unmissible.

Video of the trade:

Example 100: GBP/USD H1 on the 5-6th of October: +10% (+250 pips)

On D1, after a BDC, we have a pullback, on H4, after a huge BDC, the trend is down. On H1, we had a lovely wave 3 down on Monday the 2nd, and we expect the wave 5. On the 5th, at Francfort Open, we have a sleeping alligator and a double lower level H1-H4. We put a pending order (SL above the green line is at 25 pips) which is triggered, the prices does not go until London Open with a nice drop, then the price pulls back a bit forming 2 consecutives Inside Bars (NB: Inside bars are usually a setup on the lower time frames). We put a pending order below the first Inside bar (SL at the opposite of the candle at 25 pips) which is triggered, the price then drops harmoniously and we exit the next day before the NFP news for + 150 pips (+6%) for the first entry and +100 pips (+4%) for the addon. A marvelous +10% profit trade, a classical one: we trade the wave 5 (which will become a new wave 3) following the waves 3 and 4.

Example 99: GBP/USD M15 on the 15th of September: +12% (+295 pips)

On the 15th, D1, H4 are into an impulsive wave up. On H1, we have a pullback after a massive push of 250 pips. The ewave looks quite high so we zoom on M15. On M15, we have a clear wave 3 up following by a wave 4 and we want to take the wave 5; We can't take the first break of the box at 6.45 but we can take the break of the box newly formed at 8.30 after Francfort Open (Initial SL at 22 pips below the box), the price breaks the box but then pullback a bit forming a new buy fractal. We take a second entry above this new box (Initial SL at 28 pips below the box). The price breaks the box and flies. We exit both trades at 17.45 while the price breaks the lower level of the box for +154 pips (+7%) and for +140 pips (+5%) for a total of +12% profit, a monster classical trades!

Example 98: NZD/USD H1:22-23rd of May: +6% (+148 pips)

On the 22nd of May, at London Open, on D1 there is no trend but the ewave is about to cross the ZL, on H4, the trend is up, and on H1, we have a double upper level of the box (H4-H1). This is a second entry after a first break. We put a pending order above the double level (initial SL in the other side of the box is at 21 pips) which is immediately triggered, the price goes up and takes a break forming another buy fractal, we place a pending order for this addon which is triggred (initial SL below the green line is at 28 pips), the price goes up nicely, we exit the next, after divergence, while the candle closes below the green line for a profit of 84 pips (+4%) for the 1st entry and + 64 pips (+2%) for the addon, a total of +6% profit (+148 pips): Another excellent classic trade.

Video of the trade:

Example 97: EUR/USD H1: 15-18th of May: +13.5% (+204 pips)

This is a monster classical trade! On the 15th, on D1 this is an uptrend, on H4, we had a wave 3 and we expect a wave 5, the ewave has just crossed the zero line and the price is above the box. On H1, after a push of the price on the 12th, the price is taking a pause and has formed a beautiful box. We place a pending order just before Franfort Open which is triggered quickly (the Stop Loss is only at 15 pips), the price flies and then moves up harmoniously without going below the red line of the alligator. We exit on the 18th, after second divergence, while the candles closes below the green line for +204 pips which means +13.5% profit.

Example 96: USD/CHF H1: 9th of May: +6% (+73 pips)

After a strong move on the 8th, the price takes a break, we have 2 buy fractals during the night and the next morning, we have a very small box (12 pips), on H4, the ewave is peaking, we place a pending order at Francfort Open (the price actually broke the box before FO but retraced) above the next fractal on the left which is quickly triggered. The price flies, this is the second push of the wave 3, we exit when the price breaks the lower level of the box for +73 pips, which is +6% profit. A lovely classical setup.

Video of the trade:

Example 95: XAU/USD H1: 11-12th of April: +3.5% (+136 pips)

On the daily chart, this is an uptrend on the 11th, on H4, the ewave is about to cross the zero line, and the H4 upper limit of the box is far away, on H1, we have a valid setup after a break of the box followed by a buy fractal (The box is small with a 40 pip initial SL). The pending order is triggered and the price flies, we exit the next day, in the afternoon for +136 pips (+3.5% profit), a very classical trade. We could let the trade runs as at the break of the lower level of the H1 box, the bars on the H4 ewave were growing up, the exit on the 13th would have brought +6% profit (self half of the profit at the break of the lower level of the box and let the trade runs would have brought nearly 5% profit).

Video of the trade:

Example 94: EUR/USD H1: 29-31st of March: +3.5% (+107 pips)

This is a countertrend trade. On the 29th of March, on D1, we have a bearish chart, and we have a BDC (bearish divergent candle), on H4, we have a lovely BDC, a divergence and the Ewave is about to cross the zero line, 3 signs of a countertrend trade. On H1, we missed the first valid setup (too late in the day) following a lovely BDC and the break of the sleeping alligator box. After some pullback during the night, we take the second entry at London Open which is a double entry H4-H1 (the initial SL is at 30 pips), the price goes down and never closed above the red line neither later the green line, we exit 2 days later while the price breaks the upper level of the box for +107 pips which is +3.5% of profit. The first entry would have given us +6% profit.

Video of the trade:

Example 93: EUR/JPY H1: 9-10th of March: +6% (+160 pips)